Satyam Scandal: Raju's Billion Fraud – India's Enron

Sagsdetaljer

Quick Facts

Klassifikation:

Raju's confession: Satyam scandal and India's Enron (2009)

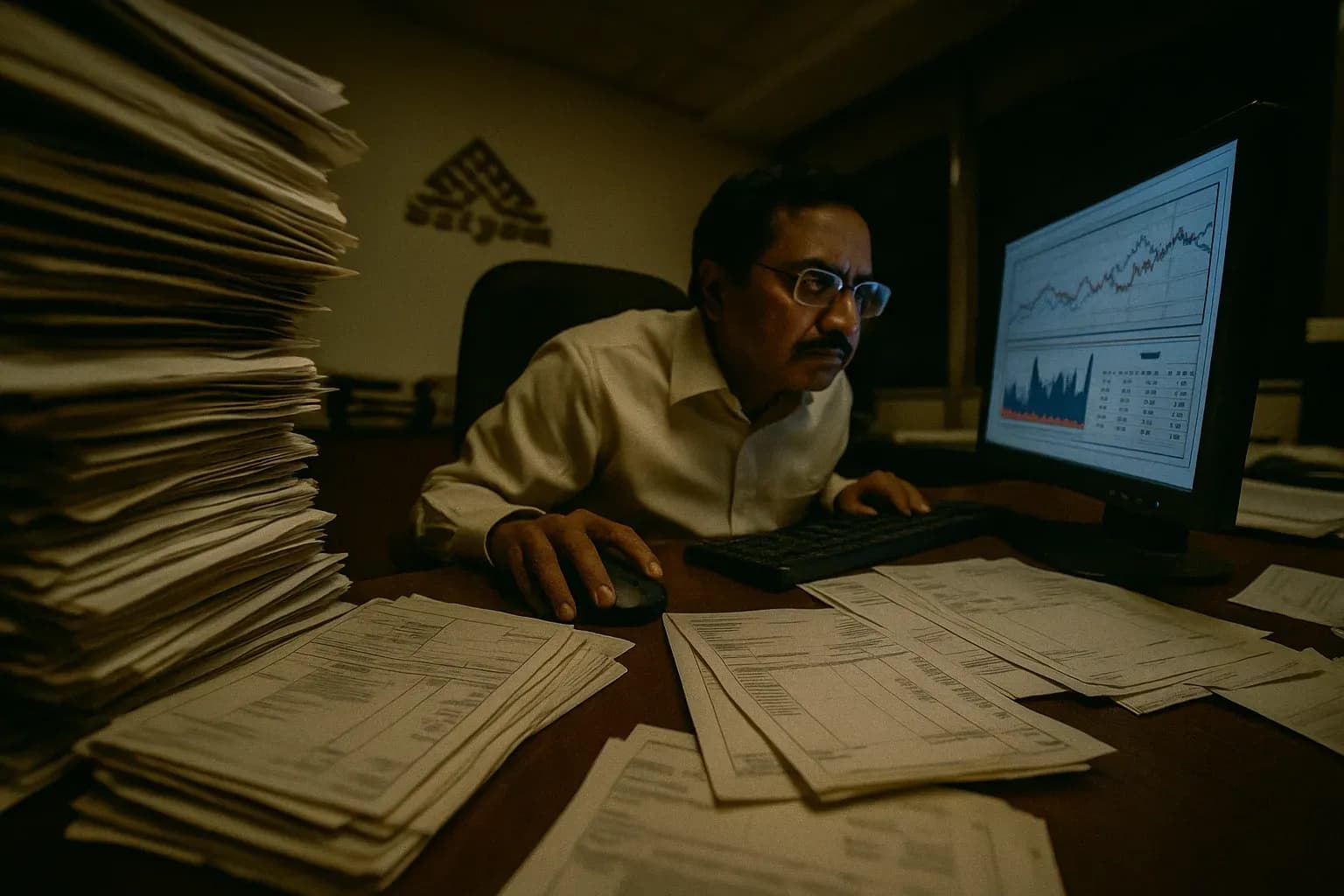

On January 7, 2009, B. Ramalinga Raju, founder and chairman of the Indian IT flagship Satyam Computer Services, shook the global business world. In a five-page confession letter to his board, he admitted to systematically manipulating the company's accounts over several years. Revenues, profits, and cash reserves had been artificially inflated by a staggering 1.5 billion US dollars. This shocking admission of financial crime triggered one of India's largest accounting scandals, an extensive fraud quickly dubbed 'India's Enron'. The case not only threatened to topple one of the country's most successful IT companies but also forced India to confront its corporate governance.

Behind the facade: From IT darling to fraud epicenter

Satyam Computer Services, founded in 1987, had grown into a giant by 2008 with over 53,000 employees and a global client base. The company was hailed as a success story of India's IT boom, known for innovation and seemingly ethical operations. But behind the polished facade, Raju's confession revealed a dark reality: the extensive accounting fraud had been ongoing since 2003, allegedly to 'smooth out' results and meet analysts' high expectations.

Cybercrime core: Fake invoices in the Satyam fraud

At the heart of the fraud was a sophisticated manipulation of Satyam's own internal IT systems – a perverse exploitation of the company's core competency. Raju created a hidden user account in the billing system, enabling the generation and concealment of thousands of fake invoices. More than 7,500 fraudulent transactions, valued at over $1 billion, were used to inflate revenue by up to 22 percent annually. To cover up the lack of actual cash reserves that should have matched the fictitious revenue, fake bank statements were produced using advanced PDF manipulation. This element of cybercrime was central to the success of the fraud.

13,000 'ghost employees': Raju's fictional fraud

One of the most bizarre aspects of the fraud was the invention of 13,000 'ghost employees'. These non-existent staff members were equipped with complete personnel files, timesheets, and fake salary payments. Through this mechanism, Raju and his co-conspirators could channel approximately $4.5 million directly into their own pockets each month. This fictitious workforce also contributed to giving investors a false impression of constant growth at Satyam.

Last straw: Raju's Maytas deal and financial crisis

What ultimately forced B. Ramalinga Raju to reveal the fraud was his attempt in December 2008 to acquire two companies owned by his sons, Maytas Infra and Maytas Properties, for $1.6 billion. This blatant attempt to siphon money out of Satyam and into family-owned companies sparked outrage among investors and drew critical scrutiny to Satyam's accounts. When the global real estate market collapsed during the 2008 financial crisis, it became impossible for Raju to maintain the facade and conceal the enormous sums missing from the company's coffers.

Arrest: CBI exposes extent of fraud (2009-2015)

Just two days after his confession, on January 9, 2009, B. Ramalinga Raju and his brother B. Rama Raju were arrested by the police in Andhra Pradesh. The case, which developed into a high-profile affair, was quickly taken over by India's federal investigative agency, the Central Bureau of Investigation (CBI). In 2010, the CBI concluded its investigation with a comprehensive charge sheet against ten individuals. The subsequent trial, which lasted from 2011 to 2015, uncovered further shocking details about the extent and technical sophistication of the fraud, including the CBI's cyber-forensic discoveries of parallel accounting systems used in the manipulation.

Verdict: Raju jailed for billion-dollar fraud (2015)

On April 9, 2015, the verdict was delivered in the extensive trial: A special CBI court sentenced B. Ramalinga Raju and nine other defendants to seven years in prison and a significant fine. The court determined that the fraud had cost investors a staggering $2.1 billion. The Satyam scandal became a crucial catalyst for comprehensive reforms in Indian corporate governance.

Aftermath: Satyam scandal forces Indian reforms

As a direct consequence of the Satyam scandal, significant reforms were introduced in India. In 2013, the new Companies Act came into force, which, among other things, introduced mandatory rotation of auditors every ten years, strengthened board independence, improved whistleblower protection, and established a national regulatory authority for auditing. Furthermore, in 2015, the Indian stock market regulator, SEBI (Securities and Exchange Board of India), significantly tightened regulations with stricter requirements for related-party transactions and increased transparency to prevent similar financial crimes.

PwC's challenge: Their role and penalty in Satyam

This scandal also hit the auditing giant PricewaterhouseCoopers (PwC) hard. In 2018, SEBI banned PwC from auditing publicly listed companies in India for two years and ordered them to pay fines and disgorgements totaling $260 million, strongly emphasizing auditors' responsibility in cases of accounting fraud.

Human costs: Job losses and Raju's stolen luxury

Beyond the enormous financial losses, the Satyam scandal had severe human consequences. Satyam's stock price plummeted by 78 percent in a single day, thousands of employees lost their jobs, and many small investors lost their savings, leading to personal tragedies for some. The subsequent trial also revealed how B. Ramalinga Raju had used the defrauded money to finance a luxurious lifestyle, a clear example of corruption and abuse of investor trust.

From scandal to rescue: Satyam's path and control

However, Satyam Computer Services' future was secured when the company was acquired by Tech Mahindra in 2009. Although the scandal tarnished India's reputation as a leading outsourcing destination and temporarily cost the stock market $3.8 billion in value, the crisis also forced the IT sector and other industries to strengthen their internal controls against fraud. The Satyam scandal is today considered a defining moment that contributed to modernizing India's financial regulation and corporate culture.

Lessons: Satyam's legacy in fighting financial crime

The lessons from the Satyam scandal are multifaceted. It underscored the vital need for independent auditing, the use of modern data analytics to detect manipulation, the importance of robust whistleblower protection, and the critical role cybersecurity plays in preventing the misuse of internal systems. Although reforms have been implemented in India, subsequent cases have shown that the fight against corporate fraud and financial crime remains a challenge. Satyam's legacy lies in its role as a painful but necessary catalyst for change in India's business landscape.

Fascinated by complex fraud cases? Follow KrimiNyt for more in-depth exposés on financial crime and corporate deception.

Susanne Sperling

Admin